ПЕФў2021ФъЙтЭЈаХвЕЮёгЊЪе43.49вкУРдЊЃЌЭЌБШдіГЄ22%

1дТ27ШеЃЌПЕФўЙЋЫОЙЋВМСЫ2021ФъЕкЫФМОЖШКЭШЋФъВЦЮёвЕМЈЃЌВЂЖд2022ФъЕквЛМОЖШКЭШЋФъвЕМЈзіГіеЙЭћЁЃ

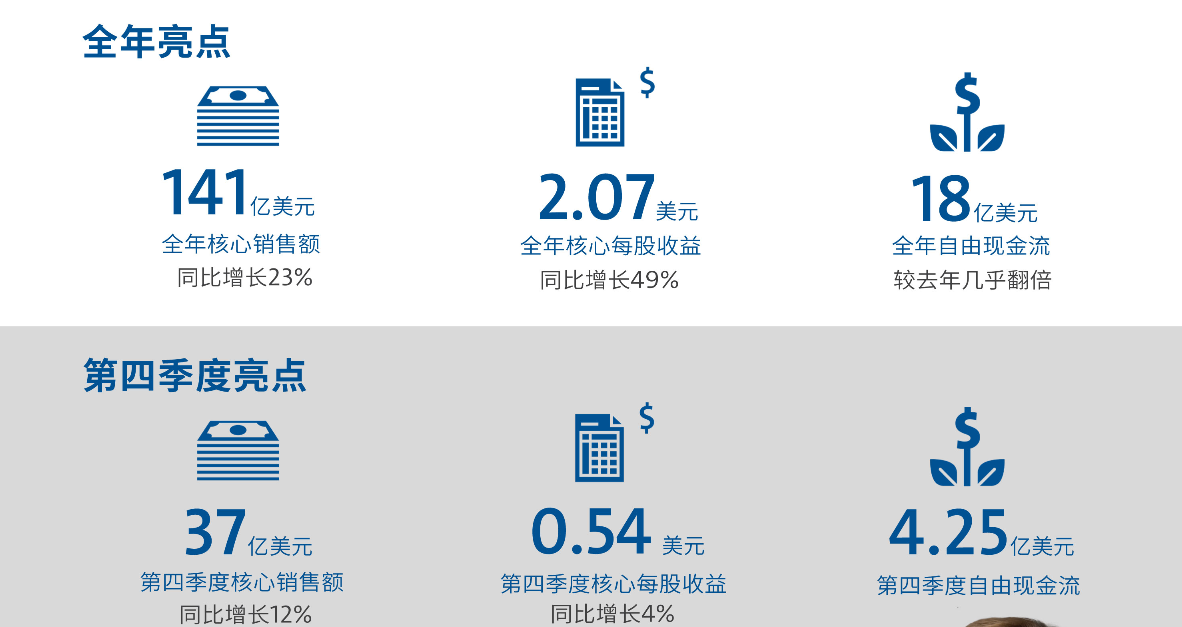

2021ШЋФъКЫаФЯњЪлЖюЮЊ141вкУРдЊ

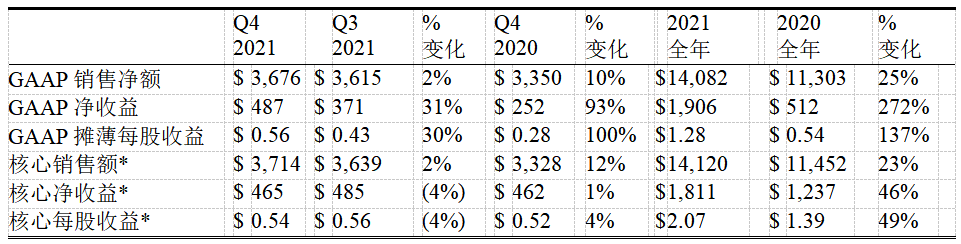

ЕкЫФМОЖШGAAPЯњЪлЖюКЭКЫаФЯњЪлЖюОљЮЊ37вкУРдЊЃЌКЫаФЯњЪлЖюЭЌБШдіГЄ12ЃЅЁЃШЋФъGAAPКЭКЫаФЯњЪлЖюЮЊ141вкУРдЊЃЛКЫаФЯњЪлЖюЭЌБШдіГЄ23ЃЅЃЌжївЊЕУвцгкЙтЭЈаХЁЂЯдЪОПЦММЁЂЩњУќПЦбЇКЭHemlock Semiconductor GroupЕФЧ§ЖЏЁЃ

ЕкЫФМОЖШКЫаФУЋРћТЪЮЊ36ЃЎ5ЃЅЃЌЛЗБШЯТНЕ180ИіЛљЕуЁЃЦћГЕаавЕГЌГЃЕФВњСПЯТЛЌЁЂЬиЪтВФСЯВПЕФМОНкадЯњСПЯТНЕвдМАЭЈЛѕХђеЭЕШдЄЦкжаЕФвђЫиНЕЕЭСЫгЏРћФмСІЁЃДЫЭтЃЌЮЊСЫжЇГжаТЕФЬЋбєФмГЄЦкКЯЭЌЃЌHemlock Semiconductor GroupжиаТЦєЖЏЖрОЇЙшВњФмЯюФПЖјВњЩњСЫСйЪБЦєЖЏГЩБОЁЃШЋФъКЫаФУЋРћТЪдіГЄ110ИіЛљЕужС37ЃЎ1ЃЅЁЃ

2022ФъЕквЛМОЖШЕФЯдЪОВЃСЇМлИёЛЗБШдЄМЦГжЦНЃЌВЃСЇЙЉЧѓДІгкНєеХзДЬЌЁЃЙмРэВудЄМЦ2022ФъећЬхВЃСЇЙЉгІНЋБЃГждкНєеХЕНЦНКтжЎЗЖЮЇФкЃЌВЃСЇМлИёЛЗОГБЃГжСМКУЁЃ

ПЕФўдЄМЦ2022ФъЕквЛМОЖШЕФКЫаФЯњЪлЖюНЋЮЊ35вкУРдЊжС37вкУРдЊжЎМфЃЌКЫаФУПЙЩЪевцНЋдк0ЃЎ48УРдЊжС0ЃЎ53УРдЊжЎМфЁЃЙмРэВудЄМЦЙЋЫО2022ФъЕФЯњЪлЖюдМЮЊ150вкУРдЊЃЌРћШѓдіЫйНЋПьгкЯњЪлЖюЃЛзЪБОжЇГіЫЎЦНгы2021ФъДѓжТГжЦНЁЃ

ПЕФўЖЪТЛсжїЯЏМцЪзЯЏжДааЙйЮКЮФЕТБэЪОЃКЁАПЕФўЙЋЫО2021ФъЕкЫФМОЖШвЕМЈдйДЮЪЕЯжЧПОЂдіГЄЁЃЙЋЫО2021ФъЕФШЋФъКЫаФЯњЪлЖюГЌЙ§140вкУРдЊЃЌКЫаФУПЙЩЪевцГЌ2УРдЊЃЌздгЩЯжН№СїЯрНЯШЅФъМИКѕЗБЖЁЃЭЌЪБЙЋЫОдіМгСЫ9ЃЅЕФЙЩЯЂЃЌВЂЭЈЙ§ЛжИДЙЩЦБЛиЙКМѕЩйСЫ5ЃЅЕФСїЭЈЙЩЁЃЮвУЧЗЂЛгКЫаФгХЪЦВЂЪЕЪЉ ЁЎMore CorningЁЏеНТдЃЌдкЭЖзЪзщКЯжазЅзЁвЛЯЕСагаРћгкЙЋЫОЖЬЦкКЭГЄЦкЗЂеЙЕФживЊЛњгіЁЃЁБ

ЗжЯэ

ЗжЯэ

ЭМЦЌаТЮХ

-

80вкУРдЊЙтЯЫНгШыЪаГЁе§дтгіГхЛї

-

ЁАЖЋЪ§ЮїЫуЁБ ГЌМЖДѓЙЄГЬМДНЋЩЯТэ

-

ЭѕеЈЃЁКрЭЈСПВњ400GЙшЙтФЃПщ

-

ЁИПЕФўЕЭЫ№КФЙтЯЫ50жмФъЁЙзЈЬтЯЕСа3ЃКгявєЭЈЛАаТЪБДњ

-

ЁИПЕФўЕЭЫ№КФЙтЯЫ50жмФъЁЙзЈЬтЯЕСа2ЃКЙтЯЫГЩец

-

зЈЗУ|EXFOЃКОлНЙИпЫйСьгђЃЌДђдьШЋаТЮДРД

-

зЈЗУ|ГЄЙтЭЈаХвЖЖЋЃКМсГжзпГіШЅеНТдЃЌДђКУКЃЭтЙЅМсеН

-

зЈЗУ|ЛєЖћБШЬиРюбєЃКНєИњПЭЛЇНХВНЃЌгУаФзіКУВњЦЗ

зюаТЛюЖЏИќЖр

-

9дТ27-29ШеТэЩЯБЈУћ>>ШЋЪ§Лс2022МЄЙтОЋУмМгЙЄгыЪ§зжЛЏжЦдьеЙ

-

ОЋВЪЛиЙЫСЂМДВщПД>>ЮЌПЦБЁЄOFweek 2022МЄЙтаавЕФъЖШЦРбЁ

-

ОЋВЪЛиЙЫСЂМДВщПД>>КЯГЩДѓаООЖЪЏгЂЙтЯЫ -- ЙтбЇЩшМЦКЭВФСЯбЁдёЖдЙтЯЫадФмЕФгАЯь

-

ОЋВЪЛиЙЫСЂМДВщПД>>ЁОдкЯпбаЬжЛсЁПСьгЂбяЗЋГіКЃШ§ВПЧњЁЊЁЊжЦЖЈгЊЯњеНЪѕ

-

ОЋВЪЛиЙЫСЂМДВщПД>>ЁОдкЯпбаЬжЛсЁП AEDTЕчШШёюКЯЩшМЦСїГЬгыгІгУАИР§

-

ОЋВЪЛиЙЫСЂМДВщПД>>ANSYSДХаддЊМўМАПЊЙиЕчдДЩшМЦНтОіЗНАИдкЯпбаЬжЛс

ЭЦМізЈЬт

- 1ЙтФЃПщВњвЕСДж№ВНЧаШыМЄЙтРзДяШќЕР

- 2зЯЙтМЏЭХдЖЪТГЄедЮАЙњБЛДјзпЕїВщ

- 3зПвэПЦММЩЯАыФъОЛРћШѓЯТЕј2504.92%

- 4УРЙњаћВМEDAе§ЪНЖдЛЊЖЯЙЉЃЁ

- 5ДЋХхТхЮїНёШеНЋгыЬЈЛ§ЕчЖЪТГЄЬжТл2800вкУРдЊЕФЁАаОЦЌгыПЦбЇЗЈАИЁБ

- 6жаЙњЕчаХЦєЖЏНгШыаЭOTNЩшБИРЉШнМЏВЩ

- 7ЛЊЮЊеМОн400G WDMЪаГЁ35%ЗнЖю

- 8жаЙњЕчаХЙтЯЫЪеЗЂЦїЩшБИРЉШнМЏВЩ

- 9ЬкбЖЁЂзжНкЗзЗзШыЙЩетМвЙтаОЦЌГЇЩЬ

- 10ЧрЕКбиКЃ100ЙЋРяКЃгђФкЪЕЯж5GаХКХИВИЧ

- МЄЙтЦїИпМЖЯњЪлОРэЩЯКЃЪа/КчПкЧј

- ЙтЦїМўбаЗЂЙЄГЬЪІИЃНЈЪЁ/ИЃжнЪа

- ЗтзАЙЄГЬЪІББОЉЪа/КЃЕэЧј

- ЙтЦїМўЮяРэЙЄГЬЪІББОЉЪа/КЃЕэЧј

- ЯњЪлзмМрЃЈЙтЦїМўЃЉББОЉЪа/КЃЕэЧј

- здЖЏЛЏИпМЖЙЄГЬЪІЙуЖЋЪЁ/ЩюлкЪа

- ИпМЖШэМўЙЄГЬЪІЙуЖЋЪЁ/ЩюлкЪа

- ММЪѕзЈМвЙуЖЋЪЁ/НУХЪа

- НсЙЙЙЄГЬЪІЙуЖЋЪЁ/ЩюлкЪа

- МЄЙтбаЗЂЙЄГЬЪІББОЉЪа/В§ЦНЧј

ЗЂБэЦРТл

ЧыЪфШыЦРТлФкШн...

ЧыЪфШыЦРТл/ЦРТлГЄЖШ6~500Иізж

днЮоЦРТл

днЮоЦРТл